3 Best Housing Stocks to Buy in 2022

HYWARDS/iStock via Getty Images

Can Investing in Housing Stocks Fight Inflation?

Concerns surrounding a slowdown in economic growth, decades-high inflation, and market volatility is prompting investors to hedge their bets on the right investments. Finding undervalued companies that are high quality and deliver attractive returns and the prospect of future earnings offer benefits sought by investors. And while it may seem counterintuitive with mortgage rates reaching 13-year highs of 5.64%, some housing stocks have outperformed most industries throughout COVID-19 and post-pandemic, offering portfolio diversification.

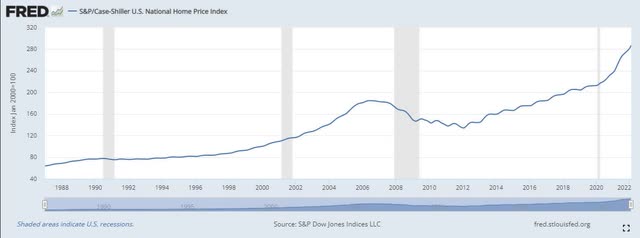

Housing Prices Continue to Climb

U.S. National Home Price Index (FRED)

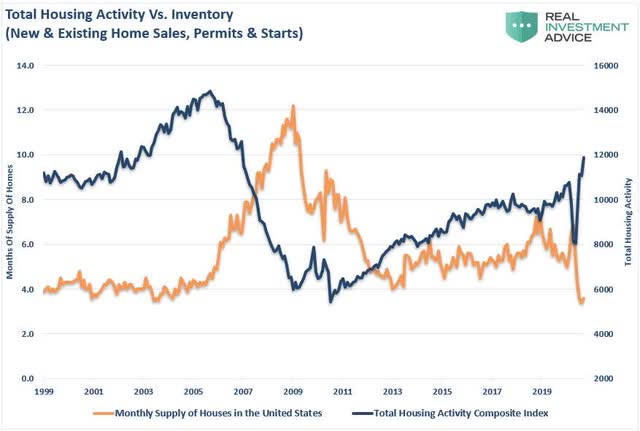

With housing prices up 34% since the onset of the pandemic, we have selected three stocks that are strong buys amid rising rates and inflation. Although many homebuilders have faced supply-chain constraints and labor shortages, along with declining stock prices, they are reaping the benefits of a vibrant housing market, with demand still outpacing supply as showcased in the chart below.

Total Housing Activity Vs. Inventory (Real Investment Advice)

Freddie Mac‘s Weekly Average Mortgage Rates (as of May 3, 2022)

Mortgage rates surged last week, and according to Freddie Mac, rates reached their highest level since 2009. The average rates as of May 3, 2022, were as follows:

-

30-year fixed rates increase 17 basis points to 5.27%.

-

15-year fixed rates increased by 12 basis points to 4.52%.

-

5-year fixed rates increased by 18 basis points to 3.96%.

Mortgage rates are exceeding levels not seen since 2009 and are on an upward trend. Despite home prices continuing to rise, the pace of growth should begin to flatten on the heels of affordability and inflationary pressures.

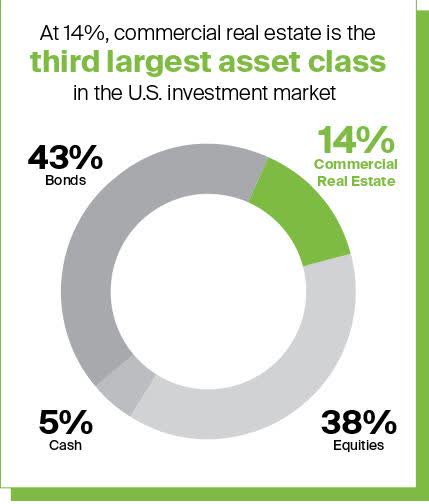

The purchase of physical properties is becoming more difficult for the average buyer. Rising mortgage rates, wage increases not keeping up with the rate of inflation, and Fed rate hikes have started a slowdown in real estate. In 3 Best REITs to Fight Inflation, I wrote that the third-largest asset class in the United States is commercial real estate. Homebuilders, construction, and building supply companies – those involved in housing – can offer a diversified blend of real estate assets and long-term total returns. These characteristics offer investors options to generate income and help boost their risk-return profiles.

U.S. Asset Classes (REIT.com)

People are weighing affordability and the cost to finance the property. However, as Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), indicates, the 2022 housing market has kept the U.S. economy resilient. As home prices and buyer demand persist, the housing market in 2022 will continue its solid run. In addition to inflation, external economic factors are likely to have impacts as well.

“This year has already thrown some curveballs, including record-low inventory and unyielding inflation…The Russia-Ukraine war and escalating fuel prices have contributed to further housing unaffordability for buyers…Mortgages now compared to just a few months ago are costing more money for home buyers,” he said…For a median-priced home, the price difference is $300 to $400 more per month, which is a hefty toll for a working family.” – Yun.

And while the housing market is slowing, the industry makes way for great buying opportunities, so we recommend three top housing stocks to buy amid rising mortgage rates for your portfolio.

3 Top Housing Stocks to Invest In

Fear is moving the markets as we’re watching massive selloffs take hold of each index, with the S&P 500 dropping below 4,000 for the first time since March 2021 and the DOW and Nasdaq plunging. Some housing and real estate stocks are excellent diversifiers to portfolios, and the real estate sector has been a solid indicator for predicting recessions or economic rallies in the past. As material costs continue to increase amid inflation and home prices rally, the housing industry provides competitive returns and long-term capital appreciation, similar to value stocks, making companies in this sector attractive buys.

1. Builders FirstSource, Inc. (NYSE:BLDR)

-

Market Capitalization: $11.32B

-

Quant Sector Ranking (As of 5/10): 25 out of 584

-

Quant Industry Ranking (As of 5/10): 2 out of 41

-

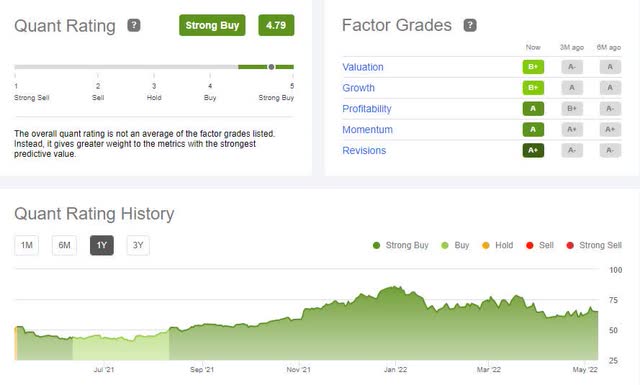

Quant Rating: Strong Buy

Stocks are selling off, allowing the opportunistic investor to take advantage of stocks at a discount, namely in an industry that continues to be strong. BLDR manufactures and supplies building materials and components and offers construction services to homebuilders, subcontractors, and remodelers in the U.S. With a deficit of three million homes and supply chain shortages adding tens of thousands of dollars onto the price of properties, Texas-based Builders FirstSource, Inc. (BLDR) is reaping the benefits. After its 2020 merger with BMC Stock Holdings, BLDR became the nation’s leading supplier of structural building and value-added products and services for residential construction, with more than $11B.

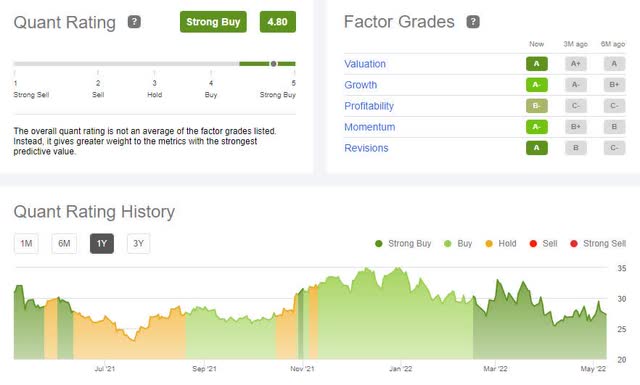

We‘ve selected BLDR as one of our top picks because it offers significant upside when looking at the Quant Ratings and Factor Grades below, but the company has continued to benefit from housing shortages, cross-selling opportunities, and robust top-line growth.

BLDR Quant & Factor Ratings

BLDR Quant & Factor Ratings (Seeking Alpha Premium)

As fellow Seeking Alpha Contributor J.B. Meathe writes,

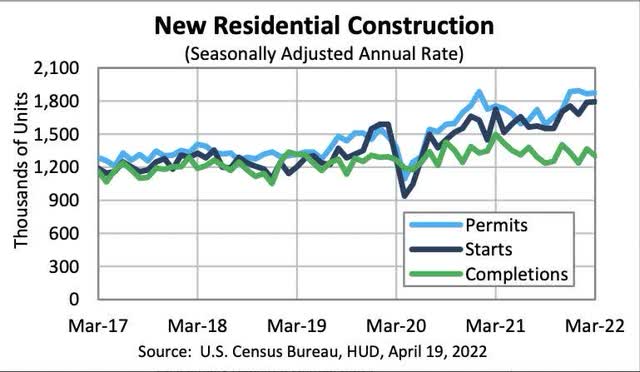

Housing starts have consistently risen over the past decade, increasing from 609,000 in 2011 to 1.6 million in 2021 (see below). The boom in housing starts during 2021 was an impetus behind BLDR’s top-line growth. As of April 1st, economists polled by Reuters are forecasting 1.745 million new housing starts in 2022. Given the tight housing market, homebuilders will keep building knowing that projects will not be vacant long after completion, which bodes well for BLDR in FY22.

New Residential Construction (U.S. Census Bureau, HUD )

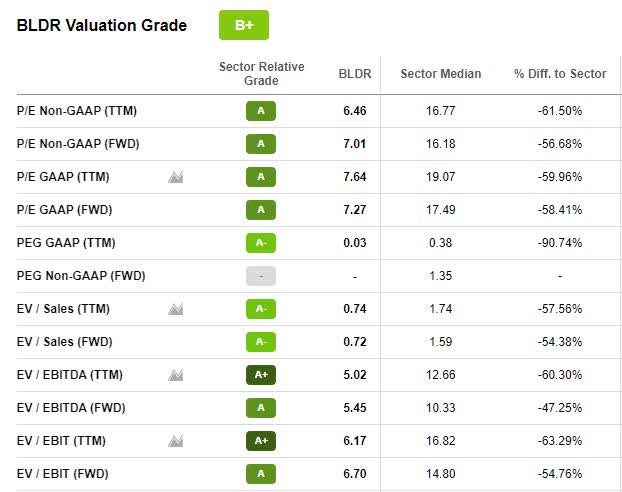

BLDR Valuation

BLDR is attractive on valuation, possessing a B+ Grade and trading below $65 per share, nearly 25% below its 52-week high. BLDR has a solid forward P/E ratio almost 60% below the industry average. Its current PEG ratio is at a 90.74% discount to the sector, indicating that BLDR comes at a great value and should continue to benefit from a bustling housing market, increasing its growth and profitability prospects.

BLDR Valuation Grade (Seeking Alpha Premium)

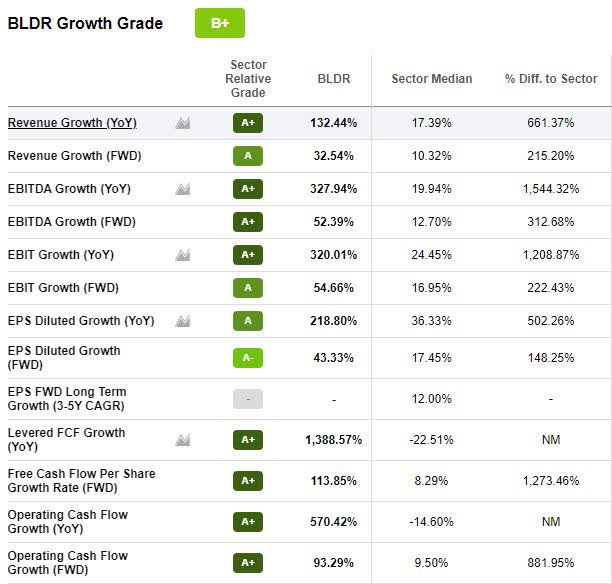

BLDR Growth & Profitability

BLDR has crushed both top and bottom-line numbers for eleven back-to-back quarters, resulting in an A+ revisions grade and 14 FY1 Up analyst revisions in the last 90 days. The most recent Q4 2021 Earnings resulted in an EPS of $2.78, beating by $0.89, and revenue of $4.63B, beating by $361.77M (83.14% YoY).

BLDR Growth (Seeking Alpha Premium)

In addition to solid earnings, BLDR‘s cash flow and leverage targets are one to two times the adjusted base, and BLDR plans to return capital to its shareholders through its $1B share repurchase program.

“We expect our base business to deliver a 10% CAGR on the top line, a 15% adjusted EBITDA CAGR, and, importantly, a 50 basis points per year improvement in adjusted EBITDA margin for a total of 200 basis points by 2025,” said Dave Flitman, Builders FirstSource CEO during the Q4 Earnings Call.

With a company paying 7x its free cash flow and lack of housing plus high demand, this stock‘s solid growth and profitability metrics should continue to lead the housing market despite interest rates increasing above 5% and potential cooling of the economy. This industry stands to continue benefiting, which is why our next pick, a REIT is very attractive and an excellent hedge against inflation.

2. EPR Properties (NYSE:EPR)

-

Market Capitalization: $3.94B

-

Dividend Yield (FWD): 6.55%

-

P/AFFO (FWD): 11.37

-

Quant Rating: Strong Buy

Although the pandemic disrupted commercial real estate, e-commerce has opened the floodgates for companies‘ demand for real estate, including storage/warehouses and data and distribution centers. REITs are publicly traded companies that allow investors to buy shares of trending real estate portfolios for a profit or hedge against market volatility. They are liquid with attractive return potential in low and high-inflation environments and trade on major stock exchanges, so I‘m including one of my top-ranked REITs, EPR Properties, to help fight inflation.

EPR Profitability Grade (Seeking Alpha Premium)

In addition to offering a solid dividend yield and raising its monthly dividend by 10%, EPR Properties (EPR) is a leading experiential net lease REIT. Focused on home leisure and recreational experiences like AMC Entertainment (AMC), Top Golf, Constellation Brands (STZ) vineyards, various ski resorts, and charter schools to name a few, EPR’s growth and profitability are excellent. In addition, as SA Contributor Leo Imasuen writes in EPR Properties: A Juicy New Dividend Payout, the REIT provides a nice yield at 5.06% (TTM). Leo comments that EPR’s financials have almost fully escaped from the destruction wrought by the pandemic and it has raised its monthly dividend by 10%. Its overall SA profitability grade is an A-, with solid cash from operations and stellar year-over-year operating cash flow growth nearly 3,000% above its sector peers. The company‘s FFO per common share of $1.11 beat by $0.15 consensus.

“Highlighting how improved the operating environment for its experiential tenants has been, EPR’s collection rate was at the high end of its expectations at 97% of contractual cash revenue. Total revenue during the quarter at $154.91 million was a 65.8% year-over-year increase and a beat of $14.52 million on consensus estimates. This was also 90.1% of its pre-Covid revenue in the comparable quarter in 2019.” – Imasuen.

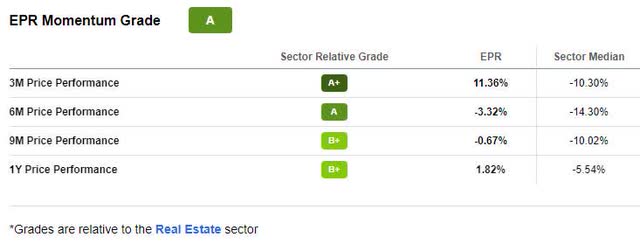

EPR Valuation & Momentum

With a B+ valuation grade, EPR comes at a steal, trading at $50.40 per share, and with EV/EBITDA and P/AFFO (TTM) figures outperforming the sector by more than 20%. Over the last year, the stock has been on an upward trend, with quarterly price performance outperforming its sector peers by more than 10% quarterly.

EPR Momentum Grade (Seeking Alpha Premium)

In addition to the significant momentum and valuation grades, there are several advantages of investing in REITs. EPR offers diversified exposure to the real estate market like other REITs, without the headaches associated with managing the properties. In addition to liquidity, EPR exposes many different types of real estate in one investment, as evidenced by the experiential examples provided above, from theaters, ski resorts, and wineries. As people continue to dine out and return to theaters, EPR‘s box office numbers climb.

“Consumers are returning to the movies…We firmly believe box office numbers will continue to improve as studios recognize this demand and increase the product flowing to theatrical release…Q1 total box office was $1.33 billion, 55.7% of Q1 2019 box office. The Batman led all titles for Q1, grossing nearly $369 million to date. Spider-Man: No Way Home continued its record-breaking performance in Q1 with over $804 million in box office to date. Uncharted, Sing 2 and Scream 2 all grossed over $80 million in the quarter. Sonic: The Hedgehog 2 provided a strong start to Q2, grossing over $161 million to lead second quarter box office,” said Greg Zimmerman, EPR Properties EVP and CIO, during the Q1 2022 Earnings Call.

With continued momentum and strength in real estate coupled with out-of-home leisure and recreational activities gaining steam post-pandemic, we believe EPR will continue to be a strong buy into the future. For our final stock pick, we have included the homebuilding company TMHC.

3. Taylor Morrison Home Corporation (NYSE:TMHC)

-

Market Capitalization: $3.32B

-

Quant Sector Ranking (As of 5/10): 5 out of 493

-

Quant Industry Ranking (As of 5/10): 1 out of 23

-

Quant Rating: Strong Buy

One of the largest U.S. homebuilders, Taylor Morrison Home Corporation (TMHC) and its subsidiaries, designs, builds, sells properties, and develops multi-use spaces. As evidenced below, possessing stellar quant and factor grades, this homebuilder is a strong buy with exceptional valuation.

TMHC Quant Rating and Factor Grades (Seeking Alpha Premium)

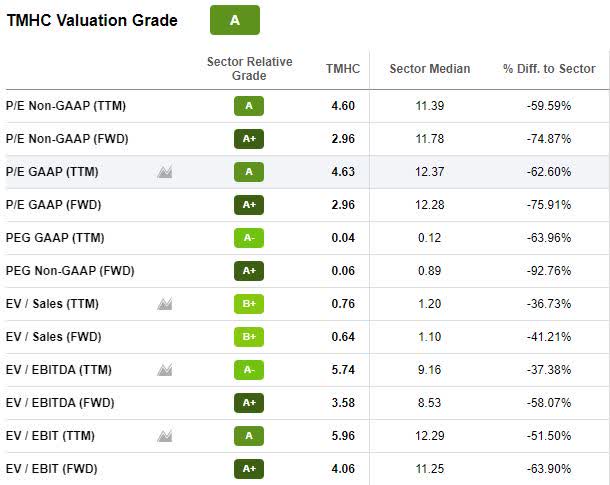

TMHC Valuation

As fellow Seeking Alpha Contributor Dr. Duru writes, TMHC has maintained relative bullish momentum despite increasing headwinds for the housing market.

Over a decade of relative under-performance has left the stock under-appreciated (AND) the market may now be missing significant upside potential as Taylor Morrison makes significant balance sheet, income, and margin improvements.

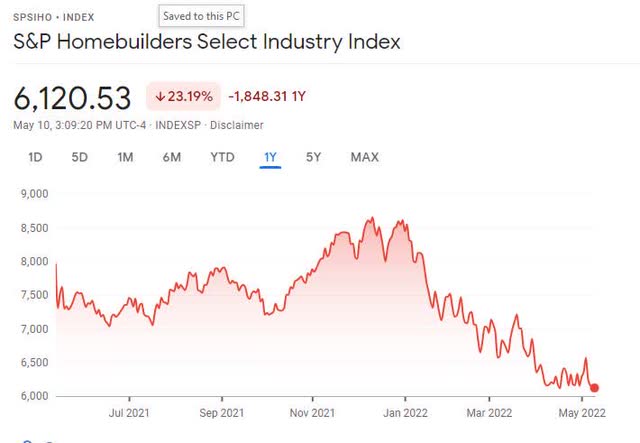

Market volatility has crushed many sectors, homebuilders included. Despite rising home prices and rents, the Homebuilder’s Index has been hit harder than the Nasdaq, as evidenced in the S&P Homebuilders Select Industry Index below.

S&P Homebuilders Select Industry Index (S&P Homebuilders Select Industry Index)

As housing affordability concerns and supply chain disruptions continue to take hold, companies like TMHC trading at severe discounts are optimal picks, especially if they have solid growth and profitability. TMHC is ripe for the picking, currently trading near its 52-week low and down 20% YTD. TMHC‘s valuation grade below shows that its forward P/E ratio of 2.96x is nearly at a 75% discount relative to its peers. With a solid A+ PEG ratio of 0.06x, TMHC is trading well below its sector peers, making it an excellent portfolio consideration.

TMHC Valuation Grade (Seeking Alpha Premium)

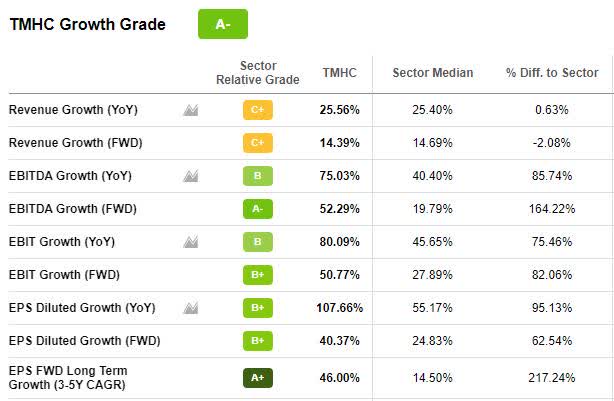

TMHC Growth & Profitability

Strong pricing has allowed Taylor Morrison to take advantage of risk-reward opportunities in the housing market and backlog conversions, prompting attractive growth, as we can see in the metrics below. With a strong balance sheet with more than $1.4B in total liquidity that includes $569M unrestricted cash, TMHC continues its rise.

TMHC Growth Grade (Seeking Alpha Premium)

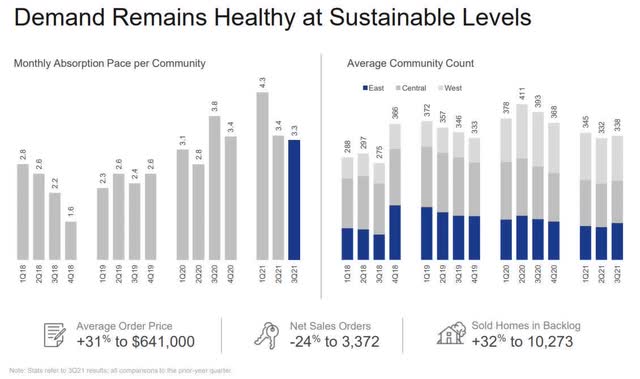

Q1 2022 Earnings were excellent, with both top and bottom-line beats. EPS of $1.44 beat by $0.18, and revenue of $1.70B beat by $48.90M (20.12% YoY). TMHC hopes that introducing more online designs, homesites, and build-to-order options will reduce expenses while maintaining demand. From Q2 to Q3 of 2021, TMHC saw its average community count increase, showcased in the below investor presentation.

TMHC Home Demand (Q1 2022 TMHC Investor Presentation)

The company‘s strong land portfolio and outlook have prompted them to raise its 2022 return on equity guidance to a high 20% range. Several factors are driving this confidence:

“Through both our organic land investments as well as multiple well-timed homebuilder acquisitions, we have established a robust land pipeline of approximately 77,000 owned and controlled home building lots, which represented 5.6 years of total supply at quarter-end…These lots are booked on our balance sheet at an attractive historic basis, considering today‘s land pricing, which is a meaningful source of embedded value that should benefit our margins and returns in the coming years. Additionally, because we already own or control nearly all of the lots needed to meet our 2022, 2023, and 2024 anticipated home closings, we are looking out to fulfilling 2025 and beyond.” – Erik Heuser, TMHC Chief Corporate Operations Officer.

With a robust backlog of homes and the average order price of homes continuing to increase along with our other housing stocks, we believe housing stocks are an excellent hedge despite expected moderation due to affordability and inflationary pressures. The three stock picks outlined are strong buys amid rising mortgage rates and based upon solid fundamentals. Consider adding them to your portfolio.

Some Housing Stocks are a Top Choice Despite Growing Market Uncertainty and Economic Headwinds

Housing stocks can offer solid returns over long periods, amid rising interest rates, especially in the current environment. In addition to increasing demand for homeownership and the pandemic expanding the time most people spend and work from home, the housing market is unlikely to experience a substantial decline, as noted by NAR‘s Chief Economist Lawrence Yun. Although mortgage rates are increasing, companies within the real estate and housing sectors have proven resilient as inflationary hedges and income-producing.

The three stock picks BLDR, EPR, and TMHC all come at a discount and stand to benefit from strong tailwinds created by backlogs, high demand, and pricing competition. Although economic uncertainty has created fear in the markets, our stock picks are excellent buys because historically, real estate serves as an inflationary hedge and there are key economic indicators that the future of housing and homebuilding should remain strong. Consider these stocks which come at reasonable price points, possess excellent fundamentals, growth, and profitability prospects, and continue with bullish momentum. We have many Top Real Estate Stocks for you to choose from to help inflation-proof your portfolio. Our investment research tools help to ensure you are furnished with the best resources to make informed investment decisions.