Will the North American box office recover in 2024? | Features

“Hang tight and get to 2025,” has become the mantra in Hollywood as the industry prepares for the trip to CineEurope in Barcelona after an underwhelming start to the year at the North American box office. Ongoing fallout from last year’s dual Hollywood strikes has resulted in an uneven release calendar, bearing the scars of delayed production and postponed releases.

What also adds to a sense of caution are ongoing concerns about older audiences not returning to theatres, compounded by a cost-of-living crisis.

Summer season has begun poorly with the lowest Memorial Day Weekend (May 24-27) in decades when adjusted for inflation. George Miller’s Cannes Film Festival selection Furiosa: A Mad Max Saga opened at number one in North America on $32.3m through Warner Bros, while all films combined delivered $132.1m. The result was 20% below that of 2023, when Disney’s The Little Mermaid bowed on $118.8m over four days.

Furiosa stood at $49.7m domestic and $114.9m global after its second weekend. It was reportedly made for $168m and will have cost the studio a further $100m to market.

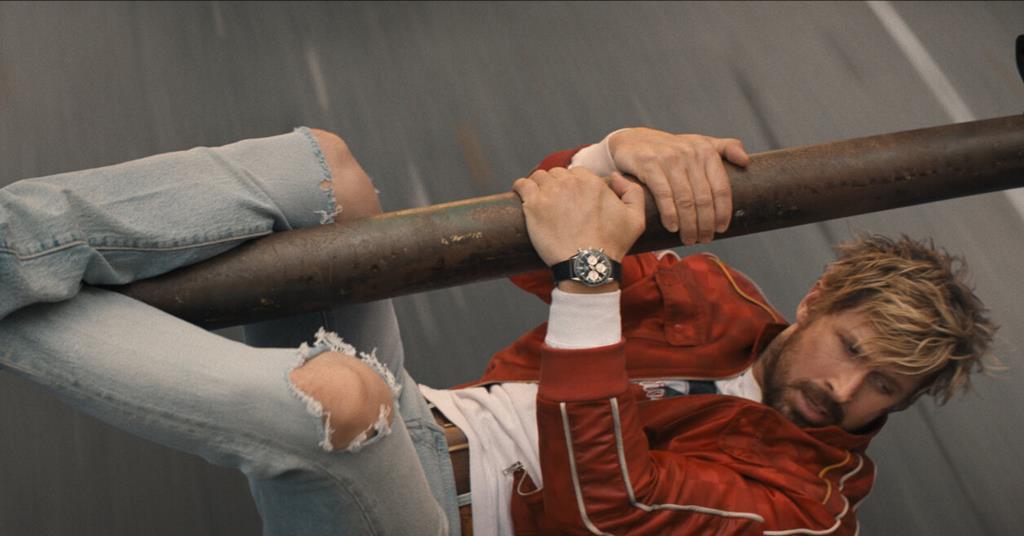

A mediocre May launched with Universal’s action comedy The Fall Guy starring Ryan Gosling and Emily Blunt, which opened over the May 3-5 weekend on $27.7m. The studio screened it at CinemaCon in Las Vegas back in April with high hopes, yet so far the film has earned $80.3m domestic and $158m global.

20th Century Studios’ Kingdom Of The Planet Of The Apes followed a week later with a decent $58m debut, and has reached $140.1m domestic and $337m global — decent, yet unspectacular for a franchise that delivered $710m worldwide a decade ago with Dawn Of The Planet Of The Apes. Paramount’s family fare IF has reached a disappointing $80.1m in North America and $138m globally after two weeks.

North America Box Office Top 10 (January 1-June 2, 2024)

| Rank | Title (country of origin) | Distributor | Release date | 2024 box office |

|---|---|---|---|---|

| 1. | Dune: Part Two (US) | Warner Bros | Mar 1 | $282.1m |

| 2. | Godzilla X Kong: The New Empire (US) | Warner Bros | Mar 29 | $196.2m |

| 3. | Kung Fu Panda 4 (US) | Universal | Mar 8 | $193.5m |

| 4. | Kingdom Of The Planet Of The Apes (US) | 20th Century Studios | May 10 | $140.1m |

| 5. | Ghostbusters: Frozen Empire (US) | Sony | March 22 | $113.0m |

| 6. | Bob Marley: One Love (US) | Paramount | Feb 14 | $96.9m |

| 7. | Wonka (UK-US-Can) | Warner Bros | Dec 15, 2023 | $85.3m* |

| 8. | The Fall Guy (US) | Universal | May 3 | $80.3m |

| 9. | IF (US) | Paramount | May 17 | $80.1m |

| 10. | Migration (US) | Universal | Dec 22, 2023 | $73.3m* |

* 2024 box office only

Comscore

All this follows a successful March, which delivered the year’s top three box-office hits so far, led by Warner Bros/Legendary’s Dune: Part Two, postponed from last November in order for stars Timothée Chalamet and Zendaya to promote the film after the SAG-AFTRA work stoppage. The sci-fi epic delivered a stirring $82.5m March 1-3 opening weekend, and as of May 30 stood at $282.1m domestic and $711.8m global.

Ranking second and third in North America year to date are Godzilla x Kong: The New Empire from the same two studios on $196.2m domestic and $567.5m global; and Universal/DreamWorks Animation’s Kung Fu Panda 4 on $193.5m domestic and $541.9m global.

Sony’s Ghostbusters: Frozen Empire pushed the 40-year franchise past $1bn globally. It has reached $113m in North America and is one of the highlights of a largely lacklustre first five months. Paramount’s Bob Marley: One Love launched in February and stands at $96.9m domestic and $179.4m global.

Holdover business from Warner Bros’ December 2023 release Wonka added $85.3m in North America this year for $218.4m domestic and $632.3m global. Sony’s romantic comedy Anyone But You starring Glen Powell and Sydney Sweeney opened in the same month, grossed $63.5m this year and has reached $88.3m, and $219.8m globally.

Alex Garland’s Civil War deserves a mention. The SXSW premiere has grossed $68.4m domestic through A24 and $114.1m global on a reported $50m cost. Luca Guadagnino’s Challengers starring Zendaya opened in April via Amazon MGM Studios and has reached $48.5m domestic and $90.3m global.

By May 30 year-to-date domestic box office trailed that of 2023 by 23.6%. The strike impact plays a big part in the lag, and comparisons are not flattering when viewed against 2023’s early smashes such as The Super Mario Bros. Movie ($574.9m) and Guardians Of The Galaxy Vol. 3 ($358.9m).

Strike action

Supply is still lacking. After Hollywood and the global industry seemed to be getting back on its feet following the pandemic, the Writers Guild of America and SAG-AFTRA went on strike last summer, effectively halting studio production for six months.

They eventually negotiated new contracts, however the spectre of industrial action has not entirely gone away. Below-the-line union IATSE is well into its negotiations with studios and streamers; its contract expires on July 31.

Barring another strike, the goal is to slowly build back the Hollywood pipeline to where it was pre-Covid. There were 95 wide releases in more than 2,000 locations in 2023 and Comscore Box Office Essentials estimates there will be 105 this year.

The recent Oscars success of Christopher Nolan’s 2023 smash Oppenheimer at Universal and a host of other titles backed by theatrical distributors were a huge source of pride to studio executives. They firmly believe that compelling films backed by strong marketing campaigns will continue to draw audiences.

Last year registered $9.05bn in North American ticket sales (against a long-term decline in admissions, partially disguised by rising ticket prices) and the consensus among Hollywood sources who spoke to Screen International is that this year could finish anywhere between $8bn and $8.5bn, which would mean between 6% and 11.5% down on 2023.

“The lack of product in the first couple of months of the year has depressed the box office,” says Jim Orr, president, domestic theatrical distribution, Universal, who nonetheless notes that “we are definitely starting to see some momentum” after Dune: Part Two and Kung Fu Panda 4. “There are big titles throughout the rest of the year that lend themselves to make us optimistic.”

Universal is on a tear after overtaking Disney in the 2023 studio share rankings and garnering seven Oscars for Oppenheimer. Highlights from its upcoming pipeline are Twisters (July 19 — Warner Bros has international rights) starring Powell; and Jon M Chu’s stage adaptation Wicked with Cynthia Erivo and Ariana Grande, which arrives in November and Orr predicts “will have people talking about it for months afterwards”.

The value of offering something for everyone is top of mind. “We have managed to do that through our relationships with our partners, including Christopher Nolan, which allows us to bring in a very broad audience,” says Orr.

Oppenheimer’s $329m North American box office and $960m worldwide compares well to the respective $636m and $1.45bn grosses achieved by Warner Bros’ Barbie and shows, distribution executives argue, that audiences will expand to accommodate great stories.

“The audience is out there when we deliver top-quality entertainment,” agrees Jeff Goldstein, president of domestic distribution, Warner Bros, who talked up the studio’s 2024 slate at CinemaCon alongside international distribution president Andrew Cripps. “It showed that a far broader audience than even we imagined turned up. The same with Oppenheimer.”

The Warner Bros executive is “feeling very optimistic” about the year ahead. After the early successes of Dune: Part Two and Wonka come the Beetlejuice Beetlejuice reboot starring Michael Keaton and Catherine O’Hara on September 6. October 6 brings Joker: Folie Á Deux, the sequel to 2019’s billion-dollar global hit that sees Oscar winner Joaquin Phoenix reprise his role opposite Lady Gaga as Harley Quinn.

The pipeline includes the bifurcated Kevin Costner western Horizon: An American Saga, whose two chapters open on June 28 and August 16. “It’s a gamble and we hope it pays off,” says Goldstein of the film, which premiered in Cannes to middling reviews.

The health of the exhibitor chains is critical to the health of the broader theatrical business. The commonly held view among Hollywood executives is the larger circuits need to divest themselves of screens in a saturated market in order to operate efficiently.

Cineworld — which owns Regal, the second-largest circuit in the US — has emerged from bankruptcy and reorganisation with less debt and is now led by former Cinepolis president Eduardo Acuna. He has invested in the multi-sensory 4DX technology of South Korea’s CJ CGV chain and has spoken confidently about the future.

Speculation continues to surround the fate of the world’s largest chain AMC Theatres. It is slowly chipping away at its debt as it tries to recover from the prolonged pandemic closures that impacted all theatre owners.

The company, led by CEO Adam Aron, announced in its Q1 earnings that revenues remained flat year-on-year, after reporting strong full-year financials back in February. On that occasion Aron attributed “literally all” of the fourth quarter revenue gain to the releases of Taylor Swift: The Eras Tour and Renaissance: A Film By Beyoncé.

The Eras Tour earned an eye-watering $180m in North America last year and more than a quarter of a billion worldwide. In mid-March it became the top music film ever on Disney+ with more than 4.6 million views (16.2 million hours viewed divided by the 3.5 hours runtime) in its first three days.

Capitalising on initiatives

AMC and Blumhouse screened recent horror hits at more than 100 locations over Easter weekend; and Aron has partnered with NBC to broadcast select live Summer Olympics coverage from Paris in 160 sites from July 27 to August 11.

Neon, the North American distributor of Sean Baker’s freshly minted Cannes Palme d’Or winner Anora and last year’s winner Anatomy Of A Fall from Justine Triet, has partnered with Ken Kao’s Waypoint on a slate of $10m-plus larger independents.

The hope is initiatives like these will complement the slates of studios and distributors and maybe fill some of the gap left by the streamers, whose theatrical distribution strategies vary.

Amazon MGM Studios is building a pipeline under head of film and former Warner Bros executive Courtenay Valenti. The company pledged in late 2022 to spend $1bn a year on 12-15 theatrical releases and executives were busily talking up their commitment to theatrical in private meetings at CinemaCon.

Apple Original Films is understood to be investing roughly the same annual amount to support theatrical. It delivered a sub-$50m box-office misfire with Matthew Vaughn’s spy thriller Argylle (with theatrical partner Universal), an underwhelming $68m for Martin Scorsese’s Killers Of The Flower Moon (with Paramount) and $62m for Ridley Scott’s Napoleon via Sony. Global numbers are higher for all three titles, and the combined gross is $474m.

Netflix executives have little interest in supporting their films with substantial theatrical releases, preferring to bring new titles directly to their subscribers.

The onus remains more than ever on the core theatrical players. As Comscore senior media analyst Paul Dergarabedian puts it: “This is a momentum business. You’ve got to keep people in the theatre exposed to in-theatre marketing and trailers, which ensures they keep going to the movies.”

“The challenge that we all have is getting audiences out to see your content and making it a great theatrical experience,” notes Kevin Grayson, Lionsgate president of domestic distribution, motion picture group. “There are companies that focus their attention on tentpoles and that’s fantastic and good for the business, but what we offer is a wide array of content in the horror, faith-based, genre and tentpole business.” Lionsgate is coming off 2023 hits John Wick: Chapter 4, which earned $187m in North America and $440m globally, and The Hunger Games: The Ballad Of Songbirds & Snakes on $166m domestic and $337m global.

The studio prides itself on the range of its films. While its Guy Ritchie war film The Ministry Of Ungentlemanly Warfare underperformed on $20.5m domestic in April, faith-based drama Unsung Hero from its partners at Kingdom Story Company earned a similar amount. Lionsgate has been a distributor of faith-based films for some time and few doubt what the genre can do after Angel Studios’ Sound Of Freedom broke out last summer on $184m in North America.

The studio opens Saw XI on September 26 after the franchise’s tenth episode earned a solid $53m in North America, and Kingdom Story Company’s The Best Christmas Pageant Ever starring Judy Greer on November 8. The Crow reboot starring Bill Skarsgard and FKA Twigs arrives on August 23, and Eli Roth’s videogame adaptation Borderlands opens on August 9.

Among other anticipated releases are Pixar’s Inside Out 2 (June 14), Marvel’s Deadpool & Wolverine (July 26), and Mufasa: The Lion King (December 20) from a Disney fold overseen by CEO Bob Iger, who has mandated a focus on fewer, higher quality films after a relatively disappointing 2023.

Paramount releases Gladiator 2 and Sonic The Hedgehog 3 on November 22 and December 20, respectively; and Sony has Bad Boys: Ride Or Die on June 7, Kraven The Hunter on December 13 and Venom: The Last Dance on October 25. It also has two films with Apple — romantic comedy Fly Me To The Moon starring Scarlett Johansson and Channing Tatum on July 12, and the thriller Wolfs with George Clooney and Brad Pitt on September 20.

Next year is the promised land, when it is hoped industry and economic headwinds will have abated somewhat. An enticing roster includes Jurassic World 4 and Wicked Part 2 from Universal; Captain America: Brave New World and Avatar 3 from Disney; Lionsgate’s Michael Jackson biopic Michael and John Wick spin-off Ballerina; Mission: Impossible 8 and The Smurfs Movie from Paramount; Minecraft from Warner Bros; and Paddington In Peru from Sony.