Disney Stock Dropped Over 30% This Year; Can It Rebound? (NYSE:DIS)

EnchantedFairy/iStock Editorial via Getty Images

If you are looking for a roller coaster ride, you should consider The Walt Disney Company (NYSE:DIS). I’m not referring to the new Guardians of the Galaxy ride at EPCOT. I’m talking about share price action.

As 2020 dawned, DIS traded for close to $150 a share. Investors then rode the stock down to a pandemic inspired low in the mid 80s, at which point the shares trundled up to an all-time high of around $203. The stock then zoomed down to a 52-week low of $99.54.

Bulls can point to pent up demand and a seemingly inexorable growth in Disney+ subscriptions. They will highlight the fact that the parks, experiences, and products division just reported the highest second quarter revenue and operating income in Disney’s history.

Bears will caution that when anyone buys anything Disney, they are engaged in discretionary spending. Therefore, with runaway inflation and the threat of a recession on investors’ minds, it is reasonable to wonder if the lines for Disney’s real roller coaster rides might be a bit shorter in months to come.

Furthermore, when one parses through the recent earnings reports, there might be reasons for concern regarding Disney+.

Where Is This Ride Taking Us?

Disney reported Q2 22 earnings on May 11th. Adjusted EPS and revenue were both below consensus. Although revenue was $800 million below analysts’ estimates, it did increase by 23% to $19.2 billion. EPS was also up 36.7% year-over-year.

Disney’s theme parks fall under the Parks, Experiences and Products segment. Compared to the prior-year period, revenues for the segment more than doubled to $6.65 billion. Operating income also increased markedly, hitting $1.76 billion. This is the highest Q2 revenue and operating income for the division in the company’s history.

In FY19, that segment generated 38% of the company’s revenues and 45.5% of operating income. In the most recent quarter, the segment brought in approximately 33% of revenues and 47.4% of operating revenue.

Increases in park attendance, hotel bookings, and cruise ship sailings, were cited as factors that drove growth. Management especially noted robust growth in guest spending.

As I said, our domestic parks were a standout. They continue to fire on all cylinders, powered by strong demand, coupled with customized and personalized guest experience enhancements that grew per capita spending by more than 40% versus 2019.

Bob Chapek, CEO

These are especially strong results considering Disney’s cruise ships were operating at reduced capacity and international travelers, who account for at least 18% of guests, have not yet returned to the parks at the rates witnessed before the pandemic.

Another transitory negative was a $268 million loss Disney reported due to the COVID related closures of the Shanghai and Hong Kong parks. Management forecast an additional $350 million impact in the upcoming quarter due to the closures in Asia.

For the first six months of FY22, the segment generated revenue of $13.9 billion and an operating profit of $4.2 billion. During all of 2019, Parks, Experiences and Products reported $26 billion in revenue and $6.7 billion in operating income.

It is reasonable to assume that the flow of foreign guests will ramp up, the cruise business will at the very least improve, and that the Asian parks will eventually reopen. Consequently, I have to conclude that barring a return to pandemic restrictions, this segment is likely to provide solid results this fiscal year.

Disney+ And More

The investing community took note when Netflix’s (NFLX) Q1 results revealed the company suffered subscriber losses. Even though the drop in subs was relatively tiny, shareholders stampeded for the exits, and the stock dropped over 40% in six weeks. Furthermore, the rout called into question the prospects for other streaming services. Consequently, when Disney reported 7.9 million net subscribers added to Disney+ in fiscal 2Q, a virtual, collective sigh of relief emerged from shareholders.

We ended Q2 with more than 205 million total subscriptions after adding 9.2 million in the quarter. That includes 7.9 million Disney+ subscribers, keeping us on track to reach 230 million to 260 million Disney+ subscribers by fiscal ’24.

Bob Chapek, CEO

Unfortunately, when I dissect the numbers, I have a variety of concerns.

Let me begin by saying that I have consistently viewed most of the streaming services with caution. (Full disclosure: that did not prevent me from making my most egregious call in nearly a decade of writing for Seeking Alpha, a recent buy rating on Netflix.)

My negative perspective is largely due to the enormous sums companies are devoting to content, and the fact that many streamers are or were losing money. This leads me to believe that the companies with the greatest resources hold a distinct advantage in the streaming wars. DIS is spending heavily to fund streaming. During the earnings call, management revealed the company expects to spend $32 billion on content in FY22 versus the previous estimate of $33 billion.

Aside from those concerns, a closer look at Disney+ subs provides additional reasons for caution.

For one, Disney’s Media & Entertainment Distribution segment’s Q2 operating income decreased by approximately $900 million versus the prior year. That was largely due to increases in programming and production costs for Disney+ and ESPN+, as well as lower operating income from Hulu. All told, this resulted in an operating loss in the Direct-to-Consumer (DTC) business of $887 million. That is a sharp increase from the $290 million loss reported a year earlier.

A close analysis of subscriber numbers for Disney+ makes the increasing sub count markedly less impressive. There are three categories of Disney+ subs, and each constitutes around a third of the total subscriber count. The following numbers are as of Q2 2022.

There is Disney+ Domestic (the US and Canada), which has 44.4 million subs. A second category is Disney+ International with 43.2 million subs, and last, and arguably least, is Disney+ Hotstar. Hotstar has 50.1 million subs.

The average revenue per user (ARPU) for the Domestic and International subs are close to the same. The ARPU for those two was $6.33 in Q2. On the other hand, Hotstar ARPU stood at $0.76 in the last quarter. The relatively weak Hotstar ARPU drags Disney+ revenue per subscriber down to $4.35. This makes the prolific growth we’ve witnessed in Disney+ a bit less impressive.

Furthermore, Hotstar added 4.2 million new customers in Q2, more than twice that of Domestic and International combined, which added 1.5 million and 2.1 million new subs respectively. Back of the napkin math tells us that Domestic grew at a 3.5% pace, International at a 5.1% pace, and Hotstar increased subs by 9.2%. Once again, the real numbers for Disney+ are not as strong as they seem.

A second concern is that Disney’s direct-to-consumer business must be pulling some viewers from the company’s linear networks.

Don’t misunderstand my perspective. I am not claiming that Disney’s streaming service is doomed for failure. Aside from Disney+, the company also brings ESPN+ and Hulu into the streaming wars. All combined, the three services have 204 million subs as of Q2, a 28% increase year-over-year.

Additionally, ESPN is the premier U.S. sports entertainment network, and its dominant position means it garners the highest subscriber fees of any cable network. ABC also reaches nearly 120 million households in the US.

Furthermore, Disney+ still has ample room to grow. With a goal of reaching 160 countries by FY23, there are plans to launch the service in an additional 50 countries this fiscal year.

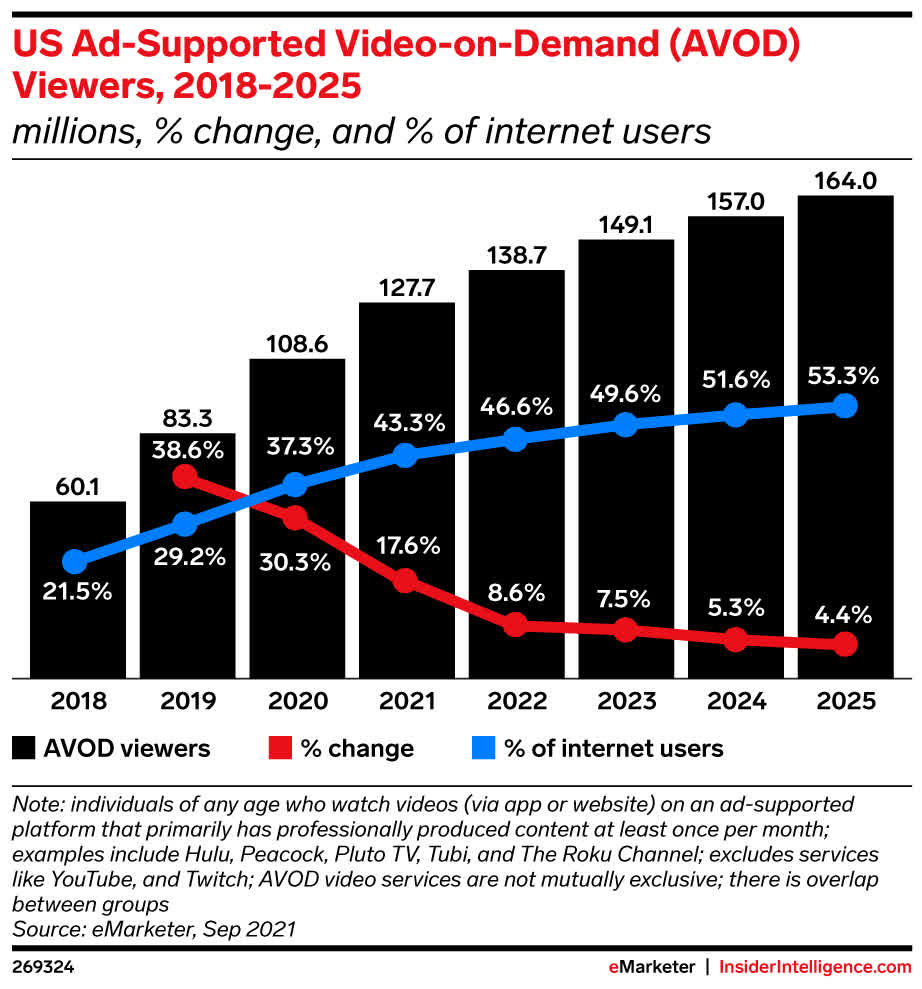

The firm also plans to launch an ad-supported (AVOD) version of Disney+ in the US this year, followed by a rollout of AVOD services internationally in 2023. The hope is that the ad-supported version will appeal to consumers that balk at the cost of streaming services while at the same time DIS garners advertising revenue. This could be particularly appealing to viewers considering the current inflationary trends and a possible recession on the horizon.

AVOD is also expected to grow at a marked pace, so this may be a sound strategy.

eMarketer

This trend is buttressed by a recent TiVo study that determined 54% of consumers with a streaming service wish a free AVOD service was also offered.

Disney continues to forecast 230 million to 260 million subs for Disney+ by 2024, at which time management anticipates the streaming service will become profitable.

Christine McCarthy, Disney’s CFO, had this to say regarding the prospects for Disney+ in the back half of 2022:

Ben, your question on net adds for the second half of the year, we still do expect an increase over the first half. However, the first half came in better than expected, so that delta that we had initially anticipated may not be as large. But we still do expect an increase in the second half to exceed the first half.

More To Consider

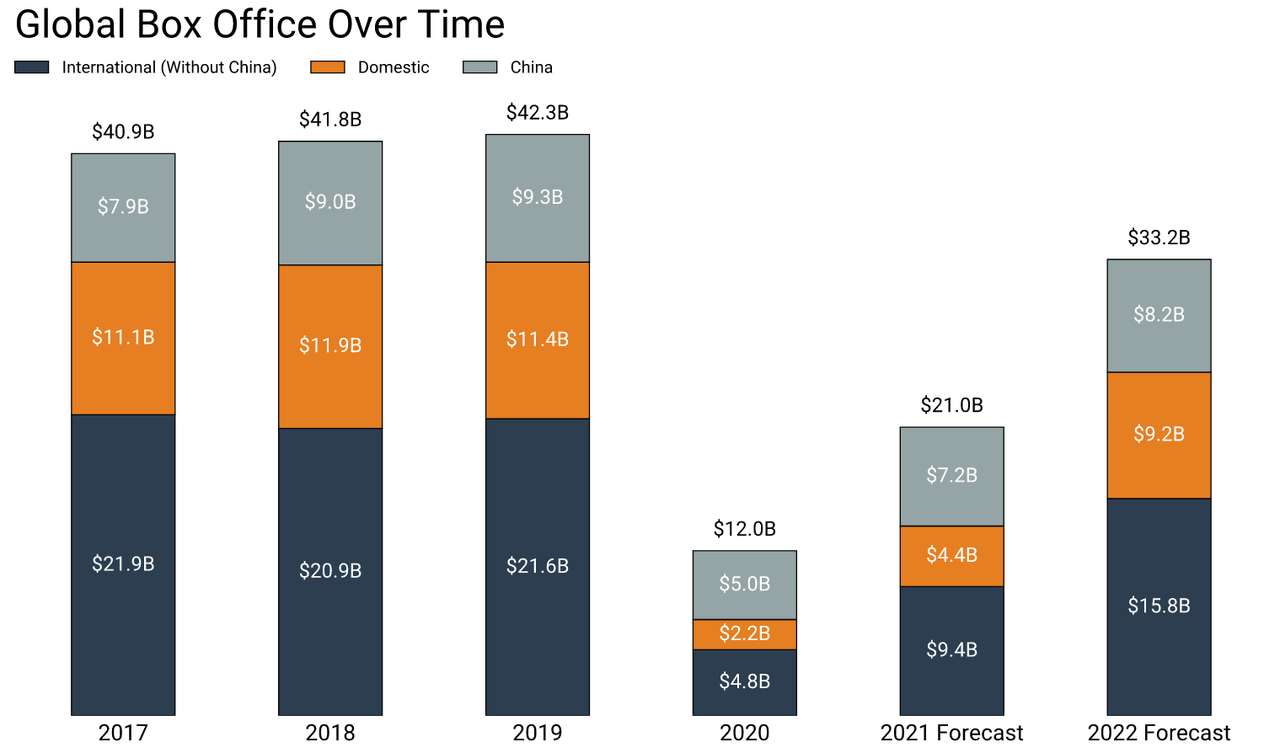

COVID-19 wreaked havoc on the movie industry. That means we can expect a significant growth in Disney’s revenues as the movie business revives. However, don’t expect Disney to record the sort of revenues from theaters in 2022 that we saw pre-COVID. The movie industry still suffers from a variety of headwinds, including capacity restrictions in some locales and lingering restraints on production.

Gower Street Analytics

Even so, the revival of the movie industry bodes well for investors – with a dose of patience.

The recently released Doctor Strange in the Multiverse of Madness pulled in $450 million worldwide in its opening weekend. That ranks as Disney’s 11th best opening of all time.

Upcoming releases include Lightyear, out this month, followed by Thor: Love and Thunder in July, then Pinocchio, Black Panther: Wakanda Forever, with Guardians of the Galaxy Holiday Special and Avatar 2 in December.

Aside from weighing short to mid-term results, an assessment of Disney’s movies plays into the ecosystem that has made the company a strong investment over the years. One can argue that the company’s movies draw visitors to the company’s parks and cruise lines and provide content for the firm’s streaming services. They are the foundation for the other businesses.

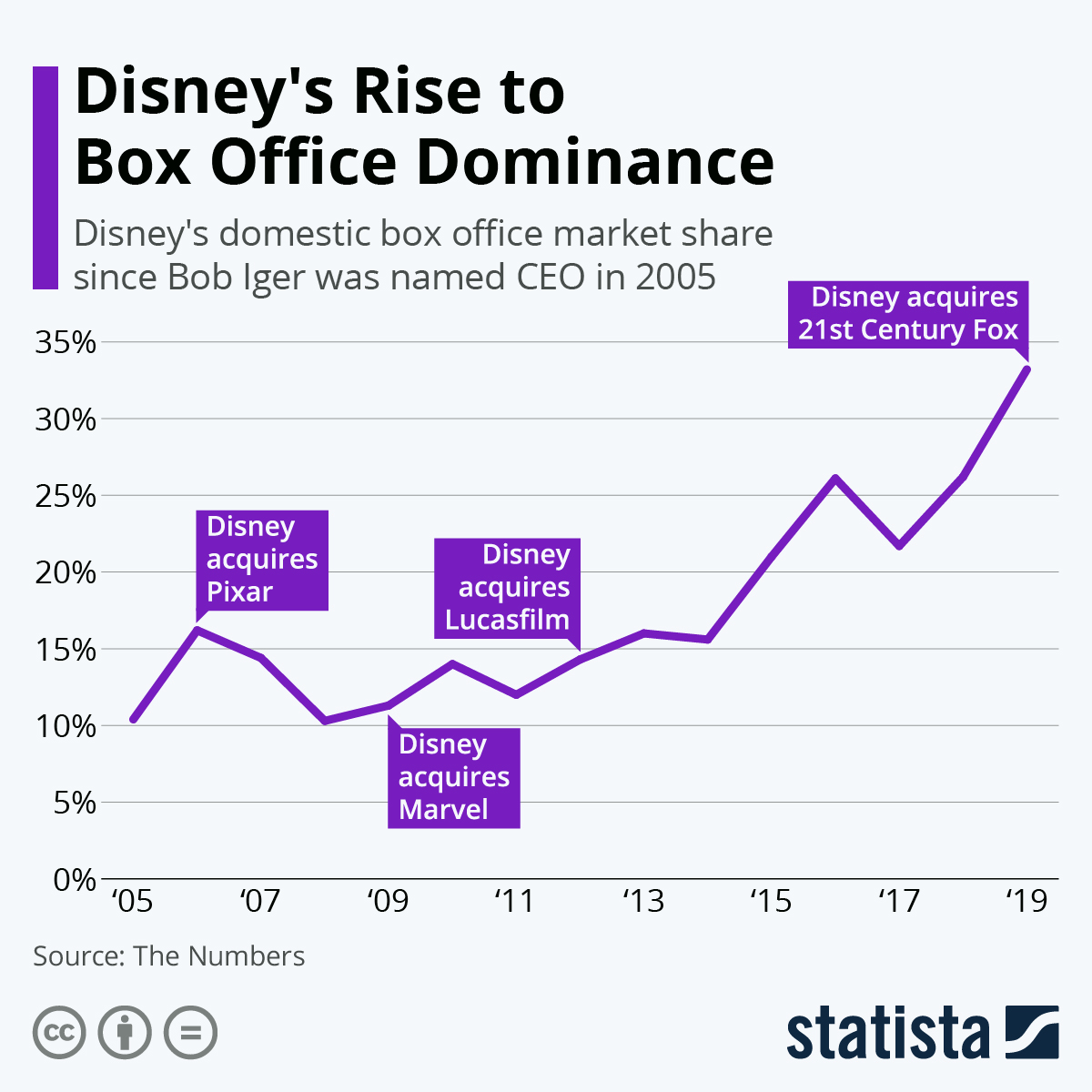

The following chart records Disney’s dominance at the box office prior to the pandemic.

Statista

To evaluate Disney as an investment, one must weigh more than just the revenues the company’s movies provide. The effect on the entire ecosystem must be considered.

DIS Stock Key Metrics

DIS currently trades for $109.95 per share. The average 12-month price target of the 23 analysts rating DIS is $173.88. The price target of the 7 analysts that rated the stock following the last earnings report is $151.33.

The forward P/E is 27.12x, a bit above the 5-year average P/E of 25.20. The 5-year PEG ratio is 0.70x, well below the company’s 5-year average PEG ratio of 3.71x.

At the end of fiscal 2Q22, DIS had $46.6 billion in debt and $13.3 billion cash.

Is DIS Stock A Buy, Sell, or Hold?

Disney’s earnings are on the rebound after taking a hit in 2020 and 2021.

Additionally, the growth of Disney+ has surpassed the most optimistic forecasts. Even so, I view the investment community’s focus on subscription growth as a bit myopic.

As I noted in this article, the competition in this space is heated, Disney+ is far from being a money-making proposition, and a close inspection reveals growing subs do not translate into a commensurate increase in revenue or profits.

I must question whether Disney’s investment in the streaming service is the best use of company resources, as the parks and its movie business provide much higher margins.

I also have reservations regarding the company’s debt levels, and the headwinds inflation and a potential recession could have on a company that relies on discretionary spending to drive revenues.

However, there is much more to Disney than its streaming service. Disney’s Parks, Experiences and Products segment just set a Q2 record for revenue and operating income. This was accomplished despite closures of two parks in Asia, a cruise ship business that has not yet recovered, and weak attendance in the US by international guests.

Disney’s movie business is also making a comeback. The value of its big screen hits does not end at the box office. To a great extent, Disney’s movies serve to drive all of the other divisions. The company is a superb example of a variety of symbiotic and synergistic forces that make Disney nearly unique.

I also view the post COVID return to normalcy as a very strong tailwind that should work in Disney’s favor over the short to mid term. As Disney’s movie and cruise ships are barely past the incipient stages of reopening, once again, there is a reasonable prospect for growth over the short to mid term.

I also believe with a PEG ratio of 0.70x, DIS is trading at a reasonable valuation.

Weighing the pros and cons, I upgrade DIS to a BUY.

However, I will add that DIS is not a sleep well at night investment at this juncture.