Movie theaters, streamers may end up friends after all

NEW YORK (AP) — After Ben Affleck and Matt Damon test screened their Nike drama “Air,” the film executives at Amazon Studios threw them a curveball.

“They said, ‘What do you guys think about a theatrical release?'” Damon said. “It wasn’t what we expected when we first made the deal.”

“Air,” about Nike’s pursuit of a shoe deal with Michael Jordan, went over so well with early audiences that Amazon, despite acquiring the film for its Prime Video streaming service, wanted to launch it in theaters. And in its first two weeks, “Air” has been a hit.

After a strong five-day debut of $20.2 million — especially good for an adult-skewing drama — “Air” dipped only 47 percent in its second weekend. Reviews have been stellar. When “Air” does arrive on Prime Video, the studio and its filmmakers expect an even better showing than if they hadn’t launched in theaters.

“It should function as free advertising to create this halo effect which in turn creates more viewers on the service,” said Affleck, who directed and co-stars in “Air.”https://www.newstribune.com/news/2023/apr/24/movie-theaters-streamers-may-end-up-friends-after/”If that’s the case, I think the business will really expand and go back to a broader theatrical model.”

Not long ago, some were predicting more and more films would be diverted from theaters and sent straight into homes. Moviegoing was destined to die, they said. Not only has that forecast fallen flat, the opposite is happening in some cases. Companies like Amazon and Apple are sprinting into multiplexes, taking a distinctly different approach to the staunchly streaming-focused Netflix. Launched on 3,507 screens, “Air” was the biggest release ever by a streamer — and it’s just the start. Amazon Studios, led by Jennifer Salke, is planning to release 12-15 movies theatrically every year. Apple is set to spend $1 billion a year on movies that will land in cinemas before streaming.

Movie theaters and (most) streaming services are turning out to be fast friends, after all.

“We truly think that by putting it into theaters, you just can’t otherwise get that kind of word of mouth and press around it,” said Kevin Wilson, Amazon Studios and MGM theatrical distribution executive. “No matter how much you spend, that’s a hard thing to replace.”

That “halo effect” isn’t quite free. It takes a robust marketing blitz to raise awareness for a film. But whether a movie is headed to a streaming platform or video on demand, the splash of a theatrical run can cascade through through every subsequent window. A film dropped straight into a vast digital expanse might go viral or quickly fade into one of a million things you can click on.

Moviegoing still hasn’t yet reached pre-pandemic levels, but it’s getting close. Movie after movie has overperformed at the box office lately, including “Creed III” (released by MGM, which Amazon owns) and Lionsgate’s “John Wick: Chapter 4.” With more than $600 million in two weeks, Universal Pictures”https://www.newstribune.com/news/2023/apr/24/movie-theaters-streamers-may-end-up-friends-after/”Super Mario Bros.” is breaking records for animated films. After a dismal 2020, a trying 2021 and a fitful comeback last year led by “Top Gun: Maverick” and “Avatar: The Way of Water,” optimism abounds that movie theaters have weathered the storm.

“It’s springtime in the theatrical business,” exclaimed John Fithian, the soon-departing president and chief executive of the National Association of Theater Owners. Today, the trade group will convene exhibitors in Las Vegas for a CinemaCon sure to be triumphant. Expect chest-thumping proclamations of revival.

Last year, Hollywood’s theatrical pipeline fell well short of the pre-pandemic rate of wide releases. With 63 percent of 2019’s wide releases, the box office reached 64 percent of 2019’s box office. The problem, exhibitors argued, was not enough supply. This year, around three dozen more wide releases are on the schedule.

“Both Amazon and Apple have signaled that they have $1 billion-plus in forward budgeting for the production and marketing of movies to be released theatrically,” Fithian said. “We’re going to get to a point in a year or so where we have more movies distributed theatrically than we did pre-pandemic.”

Movie theaters aren’t totally out of the woods. During the pandemic, the number of screens operating in the U.S. and Canada dropped from 44,283 in 2019 to 40,263, according to NATO. Though those losses are far less than many anticipated, the balance sheets for some theater chains remain strained. Regal’s parent company, Cineworld, declared Chapter 11 bankruptcy last year. The financial condition of theater owners, Fithian said, is his greatest concern looking ahead.

Streaming, though, may be departing the role of archrival. During the pandemic, studios took different roads in trying out new methods of release. But while large numbers of films, like Apple’s starry action-adventure “Ghosted” this Friday, are still going straight to streaming, some of the biggest movie suppliers have turned away from those pandemic-era experiments.

“Direct-to-streaming movies were providing really no value to us,” David Zaslav, chief executive of Warner Bros. Discovery, said earlier this year.

Since taking over the studio last year, Zaslav has dramatically changed course at Warner Bros., which spent 2021 releasing films simultaneously in theaters and on the platform formerly known as HBO Max. Zaslav has so soured on films going straight to their streaming platform that he altogether squashed $70 million “Batgirl” and “Scoob! Holiday Hunt.” The data, he has said, is clear: “As films moved from one window to the next, their overall value is elevated, elevated, elevated.”

It should be noted that many made much the same argument well before the pandemic. But Wall Street craved subscription growth from streaming services, and studios eagerly chased the reward — rising stock prices — until the bottom fell out last year. As subscription numbers slowed, the signal from Wall Street shifted to: Grow your streaming platforms but make money, too.

“We have been arguing this for years,” Fithian said. “But I’m glad that they finally got it.”

Later this year, Apple will release wide in theaters two anticipated epics: Martin Scorsese’s “Killers of the Flower Moon” and Ridley Scott’s “Napoleon.” They’ll have help. Paramount is distributing “Killers of the Flower Moon” while Sony is handling “Napoleon.” Scorsese, one of the most passionate defenders of the big-screen experience, recently said he hope companies like Apple not only release films in theaters but build cinemas, too.

“Maybe these new companies might say: Let’s invest in the future of the new generations for creativity,” Scorsese said. “Because a young person actually going to see a film in the theater, that person, who knows, five or 10 years later could be a wonderful novelist, painter, musician, composer, filmmaker, whatever. You don’t know where that inspiration is going to land when you throw it out there. But it’s got to be out there.”

Being “out there” has its risks, of course. A theatrical run can give a film the patina of something worth making an effort to see, and differentiating it from the infinite sea of content. It can also mean sinking millions in advertising into an often already expensive movie that audiences, with more competition for their attention than ever, might not flock to. “Air” cost $130 million to make. If it was a dud, it would have been more likely to go straight to streaming.

“It’s got to be the right film. This plan won’t work on every single film. Amazon is going to pick and choose the ones that make sense,” Wilson said. “The Apples of the world and maybe even the Netflixes of the world are seeing: It doesn’t have to be every movie and it doesn’t have to completely flip our business model upside down.”

Amazon notched the first best-picture nomination for a streaming service back in 2017 with “Manchester by the Sea,” and Apple won last year with “CODA.” But Netflix, the streaming pioneer, has long been the most dominant platform. And it’s remained resistant to embracing theaters.

Though Netflix gives many of its films a limited week-long run in theaters and owns two theaters (one in New York and one in Los Angeles), the streamer has typically considered its own platform its biggest marketing driver. Last fall, it gave Rian Johnson’s whodunit sequel “Glass Onion: A Knives Out Mystery” the widest release of a Netflix film. But “Glass Onion” still opened only on about 600 screens and played just five days. Most big films play on more than 3,500 screens for four weeks or more.

“Driving folks to a theater is just not our business,” Ted Sarandos, Netflix chief executive, said in an earnings call Tuesday. Netflix’s scale and reach, he said, makes them different than other steaming services. A recent popular release like “Murder Mystery 2,” with Adam Sandler and Jennifer Aniston, has been watched for 82 million hours in three weeks, according to Netflix. “Glass Onion,” despite the small footprint and modest ad-support, still made an estimated $15 million in ticket sales. Some analysts said Netflix left hundreds of millions on the table. Netflix isn’t budging, but they are, at least, no longer the trendsetter.

“I hope that they will see what Amazon and Apple are doing and realize that they can both make money in theaters and drive more subscribers to Netflix,” Fithian said. “They’re kind of the last ones to the party.”

The movie business always looks better when the hits are rolling in; a few big bombs and all the doubts will start over again. Strategies can shift. But right now, theaters and (most) streamers are finding plenty of common ground. And business is booming again.

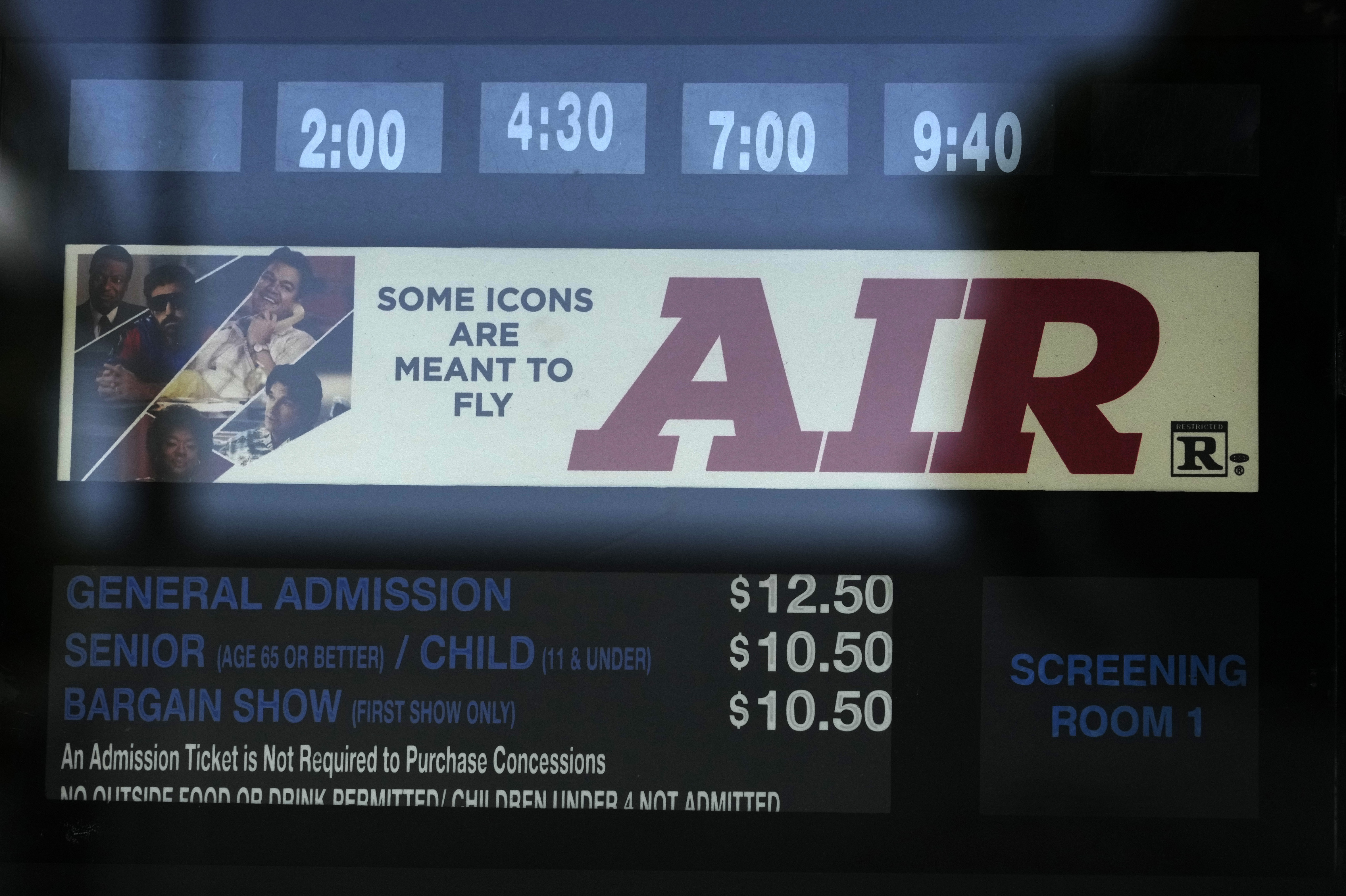

Poster art for the Amazon Studios film “Air” is displayed on the marquee of the Los Feliz Theater, Wednesday, April 19, 2023, in Los Angeles. Amazon Studios plans to release 12 to 15 movies theatrically every year, and Apple is set to spend $1 billion a year on movies that will land in cinemas before streaming. (AP Photo/Chris Pizzello)

Poster art for the Amazon Studios film “Air” is displayed on the marquee of the Los Feliz Theater, Wednesday, April 19, 2023, in Los Angeles. Amazon Studios plans to release 12 to 15 movies theatrically every year, and Apple is set to spend $1 billion a year on movies that will land in cinemas before streaming. (AP Photo/Chris Pizzello) Poster art for the Amazon Studios film “Air” is displayed on the marquee of the Los Feliz Theater, Wednesday, April 19, 2023, in Los Angeles. Amazon Studios plans to release 12 to 15 movies theatrically every year, and Apple is set to spend $1 billion a year on movies that will land in cinemas before streaming. (AP Photo/Chris Pizzello)

Poster art for the Amazon Studios film “Air” is displayed on the marquee of the Los Feliz Theater, Wednesday, April 19, 2023, in Los Angeles. Amazon Studios plans to release 12 to 15 movies theatrically every year, and Apple is set to spend $1 billion a year on movies that will land in cinemas before streaming. (AP Photo/Chris Pizzello) Ticket prices and showtimes for the Amazon Studios film “Air” is displayed at the Los Feliz Theater, Wednesday, April 19, 2023, in Los Angeles. Amazon Studios plans to release 12 to 15 movies theatrically every year, and Apple is set to spend $1 billion a year on movies that will land in cinemas before streaming. (AP Photo/Chris Pizzello)

Ticket prices and showtimes for the Amazon Studios film “Air” is displayed at the Los Feliz Theater, Wednesday, April 19, 2023, in Los Angeles. Amazon Studios plans to release 12 to 15 movies theatrically every year, and Apple is set to spend $1 billion a year on movies that will land in cinemas before streaming. (AP Photo/Chris Pizzello)