Ripple (XRP): Buy The SEC Uncertainty, Sell The Settlement News

LumerB/iStock via Getty Images

Research in my first article shows there’s not enough documented real world adoption to justify a long-term position in Ripple’s XRP token (XRP-USD). The price is not going to $10,000 or $589 or even $10. But there is a great opportunity to buy during the headwinds from the SEC lawsuit and sell on news of a settlement or legal victory. This play has gotten even more enticing because of the token’s recent price drop and the discovery of an exchange paying a healthy 6.7% interest on XRP deposits.

Recent price action

Since my last article the price of XRP has dropped over 20% from $.77 to $.61. It has also retreated relative to other cryptos, namely Bitcoin (BTC-USD) and Ethereum (ETH-USD).

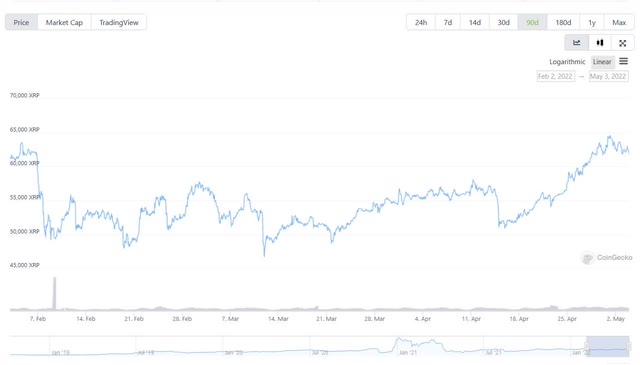

Here’s a chart of BTC priced in XRP:

Around March 22, one Bitcoin would have bought less than 50,000 XRP, but now that same BTC would buy more than 62,000.

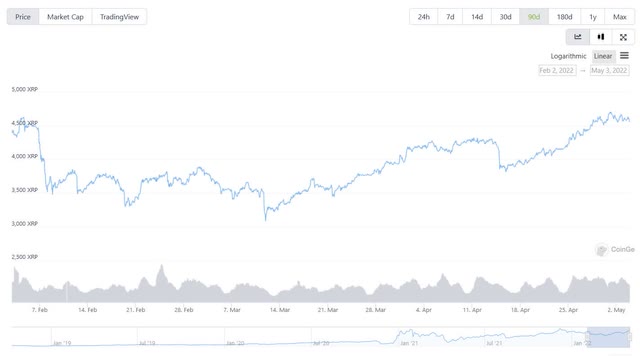

And the chart of ETH priced in XRP:

Just like BTC, one ETH buys a lot more XRP now than it did at the end of March. Regardless of whether the investor buys with BTC, ETH or fiat, XRP is on sale right now.

News and lawsuit resolution timeline

In my original article, I show the historical pattern of XRP price spikes with any favorable legal news for Ripple concerning the SEC lawsuit. But with the proceedings dragging on, we haven’t seen any recent announcements significant enough to affect the price.

The #XRPArmy continues to heavily promote the coin on Twitter, but the stories are almost always nothingburgers. Fun fact, the term nothingburger was first used in Hollywood gossip magazines since as early as the 1950s.

For example, influencers recently attempted to generate excitement about a bank in Argentina “supporting XRP.” They insinuated the institution had adopted XRP for its operations when in fact the bank was just offering BTC, ETH, and XRP to their customers for trading.

So when can we expect the lawsuit to end? Absent a settlement — which in theory could happen at anytime — the drawn-out court battle may extend into next year. “It now looks like a resolution will come in 2023,” Ripple general counsel Stuart Alderoty said in a tweet.

Vauld: an exchange listing XRP with a bonus

In my previous article, I listed several solutions for beleaguered US investors shut out of trading XRP due to exchanges delisting the coin. I have successfully used Uphold in the past. Other exchanges that say they serve U.S. customers and offer XRP are Gate.io, Kucoin, and BitYard. Please note that I have not used these services and make no claims about them.

However, I’ve recently found another exchange called Vauld that not only lists XRP but also pays up to 6.7% interest on deposited coins. Their 30-day Fixed Deposit product earns a higher interest rate by locking in your funds for a 1 month period. There is an option for auto-renewal of the Fixed Deposit but it’s simple to opt out at any time without fees or penalties. I’ve successfully transacted on this platform and been impressed thus far.

Peter Thiel’s Valar Ventures, Pantera, and Coinbase Ventures (among others) have taken a stake in the company. In fact, if you are already a Coinbase customer, signup can be done with your Coinbase credentials because of the Coinbase Ventures investment.

Bottom line

I do not expect a quick resolution of the case, but patience to await the payoff will be rewarded. Historically we’ve seen spikes of 30-75% for minor legal victories during the lawsuit; I expect the XRP price to quickly double or triple with any final resolution. Be advised that the price may decline as quickly as it rose due to savvy investors taking profits.

Buy XRP, deposit and hold for 6.7% interest, grab some popcorn, observe the legal wranglings, and sell ASAP on the news.