What ‘Slow Start’? Streaming For Netflix’s Most Popular Original Shows Was Actually Up 5% Through the First Six Weeks of 2023

On Monday, Bloomberg ran a story headlined (opens in new tab), “After a rough 2022, streaming services are off to a slow start.”

The news service punctuated its thesis in its story lead, quoting Nielsen data showing that, “Ratings for the most popular streaming originals dropped about 8% from a year ago.”

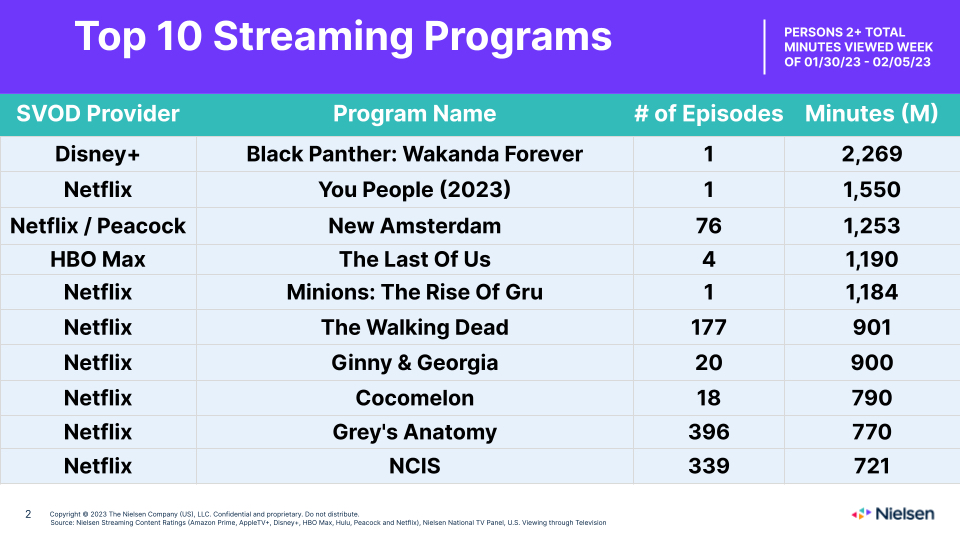

In further supporting its thesis that viewership of original shows just for streaming is down so far this year, Bloomberg noted that seven of the top 10 streaming programs for Nielsen’s most recent measurement week, January 30 – February 5, are either off-network series or theatrical movies hitting the SVOD window (see list below).

Comparing Nielsen’s Jan. 30 – Feb. 5 overall streaming rankings to its comparable numbers a year ago, we found that Nielsen’s 2022 ranker did indeed only include three shows that weren’t streaming originals — Disney Plus’ animated film Encanto, as well as offnet shows Cocmelon and NCIS.

But as Next TV revealed early last summer, Nielsen’s streaming metrics — which only measure U.S. audience “glass” (connected TV) usage and not viewing on mobile phones and tablets — can be deceiving.

Also read: Who’s No. 1 in Subscription Streaming? Muddled Metrics Methodologies Make Matters Murky

On Tuesday, Next TV tabulated and compared the viewing hours for the top five English-language films and TV shows on Netflix through the first six weeks of 2022 and 2023 and found that total streaming time was actually up 5% year over year on the biggest subscription streaming platform in the world.

And it was Netflix originals that drove this surge.

Among English-language TV series, only one non-original show, NBC off-net procedural drama New Amsterdam, factored into our Netflix tabulation/comparison. And New Amsterdam’s influence was minimal — the show only appeared once, ranking at No. 5 for the week of January 30 – February 5.

Three non-original movies made the weekly top 5 in Netflix’s English-language movie rankings through the first six weeks of 2023 — Sing, Minions: The Rise of Gru and Puss in Boots. But Netflix’s movies aren’t nearly the audience driver that its TV shows are. And only one of the titles, the Minions sequel, generated an audience of at least 20 million viewing hours in a given week.

So the bulk of viewership for Netflix’s English-language programming is generated by its most popular original shows, and Netflix’s data reveals that this viewership is up year over year, not down.

Netflix measures streaming usage on all devices across most of its 190-country footprint. And while it doesn’t offer true “third-party” measurement, comparing its numbers year-to-year does at least render an apples-to-apples snapshot.

And across both Nielsen and Netflix’s respective rankers, we are largely talking about the same shows, because Netflix’s domestic viewership base dwarfs every major SVOD competitor.

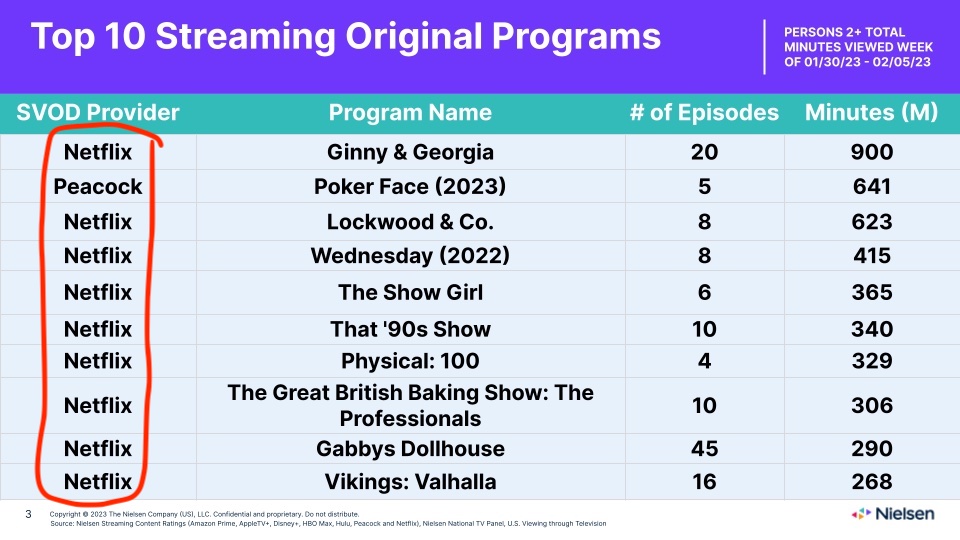

Not only are seven of the 10 shows in Nielsen’s latest overall streaming rankings on Netflix, a full nine of 10 of the entries on the research company’s sub-ranking of “streaming originals” come from the No. 1 SVOD platform.

Bloomberg probably isn’t wrong about the U.S. growth of streaming subscribers slowing overall, as the domestic market matures and big operators like Disney and Warner Bros. Discovery cut back on programming to stem direct-to-consumer losses.

Are there really fewer “streaming original” hits these days? Bloomberg said Netflix has only had “one smash” so far this year with the second-season debut of Ginny and Georgia in January. But extending the measurement period out a few weeks from January through all of February finds the “hit factor” to be fairly even year over year.

Through the first two months of 2022, Netflix saw only two series generate weekly audience consumption of at least 100 million streaming hours — Cobra Kai: Season 4 and Inventing Anna.

This year, Netflix has had three series reach that 100-million-hour seven-day benchmark through February: Ginny & Georgia (twice), Kaleidoscope and Outer Banks: Season 3.

Further kicking the tires on Bloomberg’s claim about fewer streaming hits this year:

The news service noted — quite correctly, it anecdotally seems — that HBO’s The Last of Us and Peacock’s Poker Face are the “two buzziest” TV shows of the year, across either linear or streaming.

But The Last of Us, Bloomberg said, “doesn’t count” as a “streaming original” because it can also be found on linear HBO. And notably, Nielsen doesn’t include the zombie apocalypse-themed videogame adaptation in its “originals” streaming sub-rankings, either.

In an era in which parent company WBD is aggressively pulling back from the previous management regime’s “streaming first” strategy, exactly what HBO series would now qualify as a streaming original under Bloomberg and Nielsen’s stringent guidelines? You can’t just remove HBO from the streaming discussion just because a sizable portion of its distribution is linear.

In fact, as we roll along, and media companies look to sustain their linear channels as long as they can while committing to a slower, less loss-intensive build of digital, the definition of streaming original might become increasingly blurred.

For example, are NBC shows like Night Court, which deliver sizeable streaming audiences on Peacock starting the day after episodes debut in national broadcast, just linear series?

Finally, directing the scrutiny back to Nielsen, the research company just last week published its latest monthly overall TV viewership market share summary, The Gauge, which showed that streaming usage was up nearly 10 points from January 2022 to January 2023.

Our question: How could U.S. streaming capture 10 percentage points more in share of total viewing time if usage of its most popular original shows is down 8%?